The Best Budgeting Apps & Free Personal Finance Tools

When it comes to staying on top of your spending, many of us struggle to know where every penny goes. Luckily, budgeting apps that range from beginner to advanced budgeters are available right from your smartphone. We’ve reviewed these apps usability, cost, integration with your bank, and availability across different devices to come up with this list of top budgeting apps.

The Best Budgeting Apps

- Mint — Best Free Budgeting App

- Simple — Best Bank & Budgeting App Combination

- PocketGuard — Best Personal Budgeting App

- EveryDollar — Best Budgeting App for Couples

- Albert – Best Full-Service Budgeting App

- YNAB — Best Family Budgeting App

What To Look For in Budgeting Apps

With what seems like an endless amount of options out there in terms of budgeting apps, we’ve found out which features are most important to the user by analyzing 126 data points to help find the best solution for you.

- Price: Price is important, especially if you’re attempting to build a budget and save money. That’s why you’re here right? We’ve chosen apps that are free, have a low premium, or have the ability to pay for the upgrade options you want.

- Importing & Exporting Data: All of the apps listed sync with your bank account making importing your data a breeze. Some apps take budget tracking to another level with capabilities to add in multiple financial institutions, credit cards, mortgage, and even payment apps. Depending on your situation, connecting to a bank account might be enough. We include each app’s capabilities in the features section. While your budget timeline is tracked in each app, some people like the ability to have a copy exported as a CSV, easily saved to their hard drive or available to print. We’ve included several options with this capability.

- Rewards & Referrals: Want an app with cashback features or a referral code? We’ve got you covered. Some of the apps included help you save on bills, everyday spending, or give free upgrades for referrals.

- Checking Account: Some of the options included are full-service online banks that make banking a breeze while automatically helping to budget your money. A baking feature is ideal for people who are starting their financial journey and do not have a traditional bank account set-up.

- Investing: Many of the apps allow you to link your investment account or even invest within the app itself.

- In-App Investing: This helpful feature allows users to invest small amounts of money into low-risk stocks, bonds, and ETFs. Most of the time the investment is minimal can grow faster than in a traditional savings account. This is a great way to grow your money and start investing without any knowledge or previous experience.

- Connecting An Investment Account: Best for seasoned investors or those who have higher value investment accounts. This feature can be found on more in-depth platforms.

- Platform Support: All of the apps chosen have Android and iOS capability. We’ve also included apps that have a desktop version and account sharing features. If seeing the big picture on a bigger screen is important to you, make sure you choose an app that is usable on all of your devices.

- Availability: Choose an app that works with your bank and the country you live in. All of the apps chosen are available in the USA, while a few extend to Canada and worldwide.

- Customer Service: Getting in touch with customer service due to a performance issue can be a pain. Don’t let it be! Choose an app that allows you to get in touch with them that aligns with your preferred method.

- Security: Top-notch security is a must. All of the apps have 256-Bit SSL security or higher, so rest assured that your personal details are safe. If the app includes investing and a bank account they are backed by the FDIC and SIPC protected.

- Bonus Features: The fun little extras that set each app apart from each other. Checking your credit score, finding the perfect loan, or even in-person counseling can be found in some of the budgeting apps listed. See which ones stand out to you before you sign up.

1. Mint

Best Free Budgeting App | Price: Free | Founded: 2006 | What it is: Part of the Intuit suite of products, Mint offers a high-level platform to access all of your financial needs from budgeting, investing, taxes, and more. Mint syncs with your bank and breaks down where you spend your money by automatically suggesting a household budget. Easily view your spending in professional charting and graphing tools, within minutes of connecting your bank. Using Quickbooks or TurboTax? Link your accounts to get all of your financial data in one place. Mint’s platform is sleek and incredibly easy to use. It also connects to almost any financial institution, mortgage loan, credit cards, Venmo, and Paypal.

| Features | |

| Platform Support | Android iOS Desktop |

| Availability | USA Canada |

| Syncing | Bank Account Credit Cards Investments Loans (auto, mortgage, personal) Paypal Venmo Intuit Products |

| Customer Support | Available to chat, call, and e-mail 5 AM – 9 PM Pacific time, 7 days a week. |

| The Extras | Unlimited credit score checks Highly customizable |

2. Simple

Best For: Bank & Budgeting App Combination | Price: Free | Founded: 2009 | What it is: Mobile bank and budget app that charges $0 fees. Simple is a bank run entirely online via its mobile app and desktop application. You can sign up for Simple if you are 18 years of age and have a social security number. After downloading the app and funding your checking account, Simple will help you set-up auto-pay for your recurring expenses, like utilities or subscriptions. From there Simple will begin to build you a budget based on expenses (rent, utilities, loans) and goals (think a new car or vacation). Using the Envelope Budgeting system, Simple puts money away for you based on your needs and shows you what is Safe-To-Spend. With their Safe-To-Spend feature, you’ll see what you actually have to spend after your expenses and goals are paid. Think of it as what is actually available to you, say you have $500 in your checking account but you have bills and goals to meet before your next payday, Simple shows you what you can actually spend in a period without over-drafting. Meaning that $500 might be in your account but you might only have $150 to spend on a new pair of shoes or a night out.

| Features | |

| Platform Support | Android iOS Desktop |

| Availability | USA |

| Syncing | You must have a Simple bank account to use this budgeting app. |

| Customer Support | Available for calls, in-app chat, and on social media M-F: 6 am to 4 pm PT Saturday: 7 am to 2 pm PT Closed on Sundays and holidays |

| The Extras | Account Sharing Shared Goals – friends can add to the same goals fund without sharing a bank account Safe-To-Spend Connects to Siri Absolutely 0 fees |

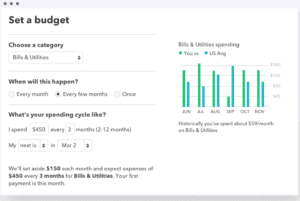

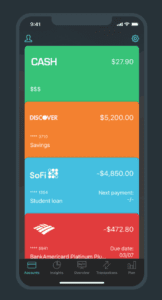

3. PocketGuard

Best For: Personal Budgeting App | Price: Free for basic version, PocketGuard Plus $3.99/ month or 34.99/ annual subscription | Founded: 2015 | What it is: Link your bank, credit cards, investments, and loans in one easy to use interface to automatically build a personal budget while finding ways for the user to save on recurring bills. PocketGuard allows a person to link all of their accounts into one sleek app. See all of your accounts on the home screen and simply tap for more information on that account. With two versions, PocketGuard and PocketGuard Plus you can start for free and upgrade to use more advanced features such as exporting data, unlimited goal tracking, and the ability to add additional spending categories. One notable feature available on both versions is the Find Savings feature. PocketGuard uses BillShark to help lower your bills like your cell phone, internet and more. Click the Find Savings tab on the web or in the app and they’ll go to work. If they are able to lower the bill, BillShark will collect 40% of the money saved as a fee for their time. If they aren’t able to lower the bill, there is no cost to you. Start tracking your net worth and have PocketGuard create a personalized budget for in just a few minutes of linking your accounts. Know what is In Your Pocket after goals and bills are accounted for and so much more.

| Features | |

| Platform Support | Android iOS Desktop Smartwatch |

| Availability | USA Canada |

| Syncing | Bank Account Credit Cards Loans Investments |

| Customer Support | |

| The Extras | Builds you a personalized budget within minutes Find Savings feature Modern app and web platform design |

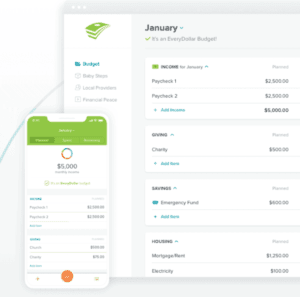

4. EveryDollar

Best For: Couples integrating their finances | Price: Free, $129/ annually | Founded: 2015 | What it is: A hands-on app that allows multiple users to get honest and real about their plan. Backed by Dave Ramsey’s philosophies and the support of Financial Peace University anyone can get on track with this full-service app. Though it can be a tough conversation, integrating your finances will be a topic of discussion at some point for most couples. Starting with the free version, couples can manually enter their income, expenses, and loans to create a household budget within a few minutes. The budgeting app will sync across everyone’s devices and the desktop version keeping everyone in the loop when either person spends, saves, or creates a new goal. With the paid version, the ability to link your financial accounts makes this even faster. Though we suggest manual entry in the beginning so both parties can get an idea of what is on the table, upgrading can be your reward for putting in the work! With your annual subscription, the two of you can even attend Financial Peace University either online or in person. Enter your zip code to find classes in your area and take the “7 baby steps to financial freedom”.

| Features | |

| Platform Support | Android iOS Desktop |

| Availability | USA |

| Syncing | Bank Account Credit Cards |

| Customer Support | E-mail EveryDollar Plus Members can make calls via the app |

| The Extras | Financial Peace University Backed by tried and true Dave Ramsey philosophies |

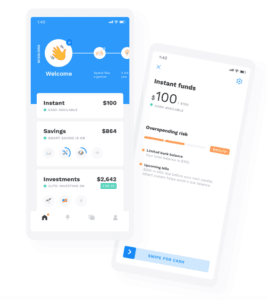

5. Albert

Best For: People who want full service | Price: Free, recommended minimum to give $4/ month | Founded: 2015 | What it is: The app you can talk to. Yes, seriously! Albert has real people finding you solutions for your financial questions by simply asking your smartphone. Link your bank account and start speaking to the “geniuses” at Albert. One of the newer options out there, Albert is a free app that collections donations from its users to fund the platform. With Albert’s complex algorithm plus the help of real people monitoring your finances, you’ll have peace of mind your finances are in good hands. Albert is a smartphone only application with many tools to start budgeting, saving, investing, and even offers lending when you need it. Albert finds money in your budget transfers small amounts to your account, $5-10 over the course of a week, and auto-saves or invests the funds to help you reach the goals you’ve set. There are 0 fees on these accounts and you can open an account with just $1. Like PocketGuard, Albert has also integrated BillShark into their app. This service investigates your recurring bills, attempts to lower them, and charges a portion of the annual savings for their time. If BillShark is unsuccessful, there is no charge to the user. The newest feature of Albert is Instant Cash. Albert will alert you if you have low funds and should take a small advance from your paycheck until your next payday. Instant Cash lets you borrow up to $100 once a pay period for $0 fees and no credit check.

| Features | |

| Platform Support | Android iOS |

| Availability | USA |

| Syncing | Bank Account Credit Cards Loans (student, personal, auto, mortgage) Investments |

| Customer Support | Chat within the app E-mail |

| The Extras | Unique concept $20 app referral for you and the user you refer Savings bonuses each month |

6. YNAB

Best For: Family Budgeting App | Price: $11.99/month or $84 year | Founded: 2004 | What it is: A platform for people who want to truly analyze and understand their spending. Using a forward-thinking approach, YNAB encourages you to spend time categorizing your spending and deciding where you want your money to go in the future. YNAB allows multiple users which pushed it to the top of the list for families. It allows everyone in your household to login via their phones, tablets, computers, and even syncs with Alexa. Teaching financial literacy at their many weekly online seminars is part of YNAB’s philosophy. Their 4–rule approach has helped 1,000’s of YNABers allocate their earnings efficiently and understand their finances. With YNAB you’ll receive inspiring content and lots of support during your budgeting journey. Expect well put together videos and tutorials to help you get your budget set-up and working for you. It’s recommended to get YNAB set-up on your computer via their desktop app. Even if you are starting from complete scratch the average users spend about 20 minutes creating their first budget. From there download the mobile and smartwatch app to nearly any device of your choosing. While this hands-on approach might not be for everyone it’s been around since 2004 and continues to gain users.

| Features | |

| Platform Support | Android iOS Desktop |

| Availability | USA Canada |

| Syncing | Bank Account Credit Cards |

| Customer Support | |

| The Extras | Tons of videos and tutorials Weekly workshops Community of YNABers |

Know Where Your Money Goes

Whether you are looking for a hands-on approach or simply need help saving for the extras in life, these budgeting apps have you covered. No matter where you stand financially starting a budget has never been easier (or more fun!) than now. We hope our top picks for budgeting apps will give shine some light on where and how to get started for your specific situation.