Self-employed individuals can choose from many bank accounts, but few of them provide an experience just for them. Found provides business owners and freelancers with a banking haven. Found is a fintech company that provides banking services through its partnership with Piermont Bank, Member FDIC.

What is Found Business Banking?

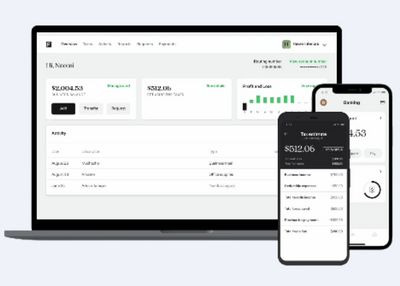

Found Business Banking is a banking solution for self-employed workers. The company is on a mission to provide independent contractors, freelancers, and other self-employed business owners with the support, structure, and confidence to work for themselves. Found takes care of the banking side and provides accessible tools and insights that allow self-employed individuals to focus more time on their work.

Who is Found Business Banking Best For?

Found Business Banking can help many consumers. It has advanced banking solutions, but it’s best for self-employed workers and small business owners. The platform offers several features that can streamline your business banking experience. In addition, it has the necessary features in one place, so you don’t have to log into multiple platforms and remember numerous passwords.

What Does the Business Banking Platform Found Offer?

Business owners can choose from several financial institutions and fintech companies. So what makes Found stand out? Here are some of the key features Found provides for business owners who use the platform.

Business Banking

A Found checking account is your pathway to the banking platform’s top resources. But the checking accounts are impressive in their own right. Found has a seamless sign-up process that doesn’t involve any credit checks, and you also won’t have to worry about fees. There aren’t required monthly or hidden fees, and you won’t have to maintain a minimum account balance. You also get unlimited transactions with a Found checking account.

Business Debit

Every Found account comes with a virtual & physical debit card. You can use the virtual card right away while waiting for a physical copy to arrive in the mail. Business owners can add the card to their Apple Pay or Google Pay wallets. Found members receive notifications each time their card is involved in a transaction, making it easier to detect theft and respond accordingly. You can freeze the card right from the app to ensure a thief can’t continue using your card. Freelancers and other self-employed workers can use these cards to send payments to people through their phone numbers or email address.

Accounting

Bookkeeping is a pillar of all businesses. This work helps you stay on top of expenses, understand the health of your business, and be better prepared for tax season. Instead of tracking everything on a spreadsheet, Found handles the work for you. The platform automatically categorizes every expense and provides detailed reports on your business. It lets you know about available tax write-offs, so you’re saving as much money as possible on taxes without the guesswork. It also lets you scan & save receipts right in the app so you can say goodbye to the stacks of paper receipts.

Taxes

Tax season can turn into a headache, but Found makes it a lot easier. Not only does their expense categorization feature come into play with automatic write-off tracking, but the banking solution also calculates how much you will owe in taxes. Users can set up an auto-save feature, so they allocate a percentage of each payment to a separate tax account and keep that money out of sight and out of mind. Having a tax estimate and building toward it can make tax season less stressful. To top it off, you can pay taxes straight from the Found app.

Invoices

Found’s unlimited, free invoice solution simplifies getting paid. It’s easy to create and send them to clients within seconds, even on the go, from your phone, and you can send as many as you want at no cost. Found invoices enable payments via payment apps, and you can customize your invoice, so it has your branding. Invoices help you collect payments. Found provides professional solutions with more coverage than other invoice apps.

How Much Does the Found Business Banking Platform Cost?

Found does not have any required monthly or hidden fees. You won’t have to worry about these costs eating into your company’s profit margins. The fintech company does not have any transaction fees.

What Do Found Customer Reviews Say?

Reviews help consumers gauge a company’s ability to provide quality services. Here are some of the reviews Found has received over the years.

- “First and foremost, IT WORKS!!! I have had trouble with other apps and their cards while paying for random purchases and even bills. Not with Found so far. Works every time.” — Eric Loney (TrustPilot Review)

- “I have been using Found for a little over 4 months. We recently expanded our business, and I needed to keep our marketplace orders/expenses/earnings separate from our B&M/Ecomm business without the hassle of opening a new bank account, having a minimum cash flow, and all that extra hassle. Found has been great for us and our needs. I rarely ever leave reviews for anything, but this one is well-deserved. We strictly only use this account for our marketplace sales, but I am actually considering switching over our e-commerce business to Found. We receive deposits in real-time and don’t have to wait 2-3 days with traditional banks. We can also send professional invoices to customers with our brand, logo, and other information. It makes it easy for us to pay our quarterly taxes with the categorization of every purchase or expense in Found. It cost us absolutely nothing to open our Found account, yet Found has given us so much financial freedom and free time with the utilization of their services right at our fingertips. Just this morning, I saw we received cash back for a few purchases — Found, I would love to know a list of businesses for that we can earn cashback incentives, please! All in all, we are very happy with Found, and I see us being a long-term account with Found. There’s no reason for us to leave. Thank you for being affordable (free) and, most importantly, user-friendly. Y’all are amazing!” — Lo Marie (Apple App Store Review)

- “Best app by far for sending invoices and for repeat series of invoices. Along with being able to keep up with taxes through it makes it so much better than the competition. I am able to run my business stress-free of the invoice situation; the only thing I would love to see in the app is a way to send the client a receipt after they pay their invoice. But for what the app says it can do, it does it all and does it perfectly!” — Austin Alexander (Google Play Store Review)

How to Get Started with Found Business Banking

Found business banking has a straightforward application process that only takes a few minutes and doesn’t involve any credit checks. You can visit Found’s website and click the “Get Started” button. You will then be prompted to create an account and provide basic information. Found will ask for the following:

- Your legal name and address

- Social Security Number (SSN)

- Your date of birth