As traditional banks offer more online features, customers visit their local branches less often. Why visit your nearby branch to deposit a check when you can take a picture instead? Even if you barely visit your local bank, the bank still has to pay for each building. Those costs often result in more fees and stricter balance requirements for customers.

FIntech platforms like Varo and Current do not have any physical branches. As a result, these online entities have less overhead and can pass the savings to their members. In addition, these platforms tend to have more leniency with fees and a suite of features to strengthen your finances. We will compare Varo and Current to help you decide the best financial management experience for your needs.

Overview of Current

Current is a financial technology company and mobile app that helps members save money and build wealth. Members can create checking and savings accounts on the Current app. Current was founded in 2015 and is headquartered in New York.

Overview of Varo

Varo is a mobile app that makes money work for all of us instead of some of us. You won’t have to worry about monthly account balance requirements or hidden monthly fees. Varo was also founded in 2015, but unlike Current, it is headquartered in San Francisco.

Comparing Varo vs. Current

Varo and Current are both enticing online apps. We have outlined some similarities and differences between the fintech companies to help you choose the right one for you.

Fees

Varo

Varo has no hidden fees or monthly maintenance costs. Varo also provides some leniency to account holders for overdraft fees. You can get a Varo Advance, which provides instant cash instead of overdraft protection. One simple fee applies if you want to get a Varo Advance above $20 (Varo members can borrow up to $100). You will need $1,000 in combined deposits to your checking account, savings account, or both within the past 31 days. Varo has a $2.50 fee for each out-of-network ATM withdrawal.

Current

Just like Varo, Current has no hidden fees or monthly maintenance costs. Current also helps with overdraft fees, but they let you overdraw your account. Instead of providing a cash advance, Current lets you overdraw up to $200 before charging overdraft fees. Current gives you more space than Varo before charging overdraft fees. Current has a $2.50 out-of-network ATM fee and a $3.50 fee for each transaction where you add cash.

It’s free to sign up for a Current account, as there are no monthly or annual fees.

Interest Rates

Varo

Varo has better interest rates than Current. While a savings account starts with a 2 percent APY (lower than Current), you can get it up to 5 percent APY. To qualify for 5 percent APY, you have to receive $1,000 or more in direct deposits this month and have positive balances in all of your Varo accounts. The 5 percent APY only applies to the first $5,000 in your savings account. Every dollar above $5,000 generates 2 percent APY.

Current

Current offers a universal 4% bonus on its savings accounts, also known as savings pods. You can only store $2,000 in a Current savings pod and create up to three savings pods. That means you can only earn up to a 4 percent bonus on up to $6,000. That’s $240/yr, which is the same amount you would make with $4,800 in a Varo savings account, yielding 5 percent APY. Varo also lets you earn 2 percent APY on every dollar past $5,000, while Current has a hard cap of $6,000.

Savings and Checking

Varo

With Varo, there are two account options to choose from. Its FDIC-insured accounts, which include savings and checking accounts, have no hidden fees or minimum balance requirements. Varo has a network of 55,000 AllPoint ATMs where you can make fee-free withdrawals any time of the day or night.

Current

Current savings and checking accounts have the same advantages as Varo accounts. However, Current only has a network of 40,000 AllPoint ATMs, which is still impressive. However, Current members cannot exceed $10,000 for their debit card balances. If you exceed this limit, you will have to move funds to a different bank to get below the threshold. Still, there is no minimum balance requirement.

Customer Experience and Service

Varo

Varo has several support articles, an email address, and a phone number. The company does not make you jump through hoops to find contact information in case the support articles do not answer your questions. Varo’s customer support hours are 8 a.m. to 4:30 p.m. MT every day of the week. The fintech company’s customer service representatives take off on Thanksgiving, Christmas, and New Year’s Day. The Varo mobile app has over 116,000 App Store reviews, averaging 4.9 stars, and over 151,000 Google Play reviews, averaging 4.8 stars.

Current

Current has a live chat and a ticket submission feature that lets you reach out to customer support. The online fintech platform also has an FAQ and Knowledge Base section. A phone number is not posted on Current’s website, but they have 24/7 customer support. The Current mobile app has over 130,000 App Store reviews averaging 4.7 stars and over 139,000 Google Play reviews averaging 4.6 stars. Varo has a slight edge in average stars, but that should not be the decisive factor in your decision. It would be more noteworthy if either app had an average rating that was one star higher than the other.

Safety and Security

Varo

The funds in your checking and savings accounts are insured by the FDIC. In addition, all Varo debit cards include EMV chips.

Current

Current offers FDIC-insured accounts through Choice Financial Group. Their debit cards also feature EMV chips, which add an extra layer of protection.

Other Account Features

Varo

- Varo Advance: Receive your paycheck up to two days ahead of schedule

- Round up: Grow your savings when you make debit card purchases by rounding to the nearest dollar

- Save Your Pay: automatically move a percentage of each paycheck to your savings account

- Credit history: The Vary Believe secured credit card does not require a hard inquiry to obtain. Varo will report your credit activity to the major credit bureaus. Varo credit cards have no APR or security deposit requirements

- Cashback debit cards: Varo sends money to your bank account each time you reach $5

Current

- Budgeting tools: Track your spending and discover ways to better manage your money

- Cashback debit card: Earn up to 15 x points on qualifying purchases.

- Teen Account: Make financial management more accessible to your child. They get more control over their finances, but you can still monitor their spending and block certain merchants.

- Faster Direct Deposits: Get paid up to two days early

- Crypto: Current members can invest in over 30 cryptocurrencies from the mobile app. When you cash out on crypto, the funds are immediately available in your bank account. You don’t have to wait for the money to transfer from your brokerage account to your checking account.

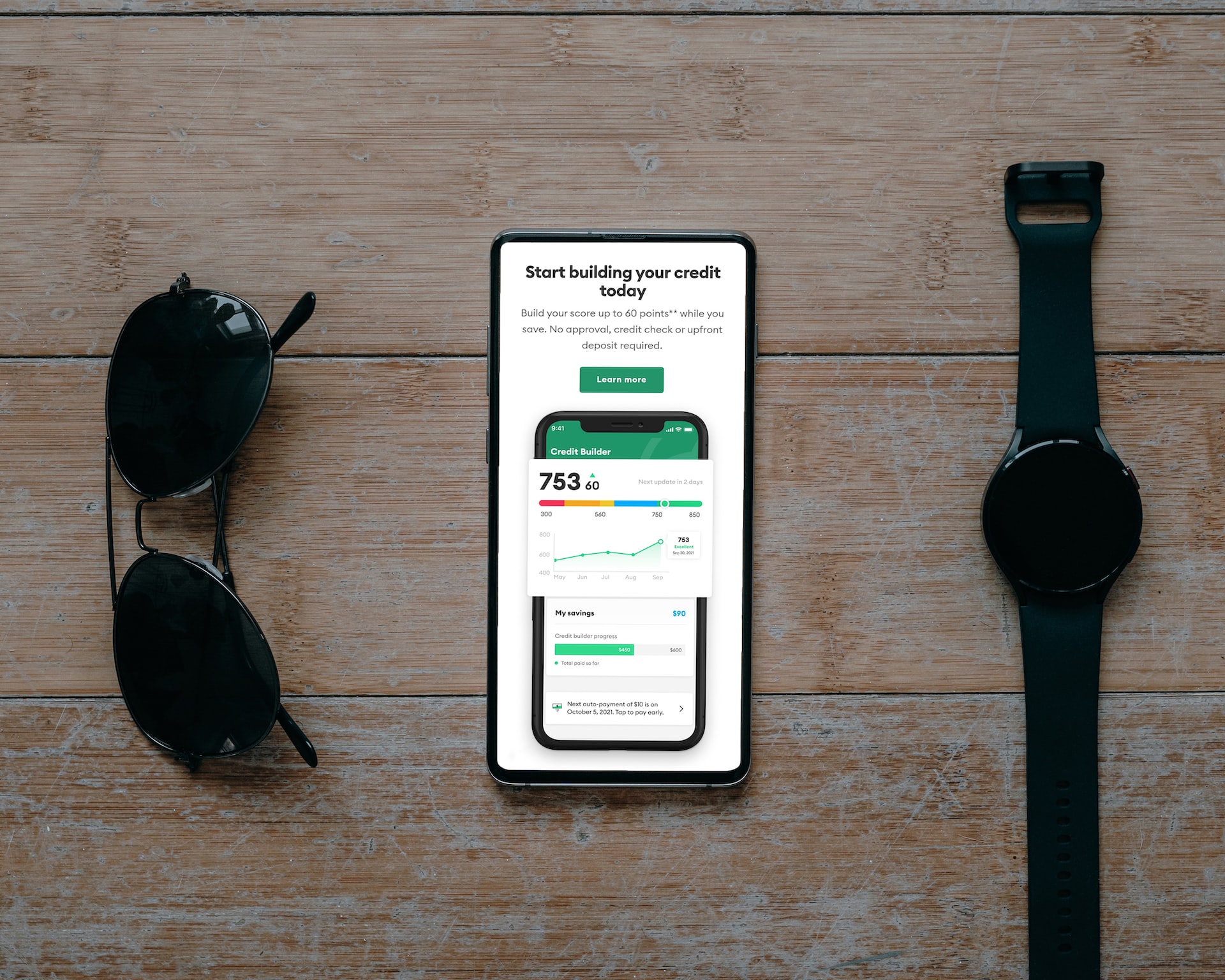

Credit Building Cards

Establishing a good credit history is essential if you want to take out a loan or apply for a credit card in the future. However, it can be challenging to build credit if you’re just starting out or have a low credit score. This is where the Current Build Card comes in. By using this card, you can establish a credit history or strengthen your credit score without having to worry about high fees or interest rates.

Issued by Cross River Bank, the Build Card by Current is accessible to anyone with a Current account. Even better, you don’t need to agree to a credit check, which could negatively impact your credit score, to be eligible for a card.

Unlike most secured credit builder cards, Current does not require a security deposit to set your credit limit. Instead, it is determined by the balance in your Current account.

Another attractive feature of the Build Card is its low fees and zero interest rate. You can also earn a bonus of up to 4 percent if you use Current’s Savings Pods. This makes it a great option for those who are looking to save money while also building their credit history. The card also offers a number of other benefits, including fraud protection and the ability to set spending limits.

It’s easy to get started with the Current Build Card. Simply open a Current account and transfer funds to create a credit limit. Once you’ve taken these steps, you can apply for a card and start building a credit history.

Ultimately, the Current Build Card is an ideal option for anyone who wants to establish a credit history or strengthen their credit score. With its low fees, zero interest rate, and unique features, such as not requiring a security deposit, the Build Card is an excellent choice for anyone who wants to save money while improving their credit profile.

Where Does Varo Stand Out?

Varo has a great APY on savings accounts and reports your credit card activity to the major bureaus. The company lets you receive paydays up to two days in advance.

Another area where Varo excels is in its credit reporting. The company reports your credit card activity to the major bureaus, which can help you build your credit history and improve your credit score over time. This is a great feature for those who are looking to establish or improve their credit.

If you prefer to use a debit card instead of a credit card, Varo still has you covered. The company offers rewards for your purchases, which can help you save money on everyday expenses. This is a great way to earn cash back on purchases that you would be making anyway.

Where Does Current Stand Out?

Current has a vast array of money management tools that can improve your spending and help you hit your income goals sooner. While Varo offers a higher APY on savings accounts, Current still offers a respectable 4 percent bonus for their savings pods. Current also lets you trade crypto without any fees. Making these trades from a central source eliminates delay times when converting crypto into cash for an emergency expense. Both have overdraft protection, but Current has more coverage.

How to Open an Account with Varo

Opening an account with Varo is a straightforward process that can be done in minutes. Simply visit the Varo website or download the Varo app and follow the prompts to create an account. You will need to provide personal identification and your social security number to complete the registration process. With nearly seven million users, Varo is a popular choice for those who want to manage their finances more effectively.

How to Open an Account with Current

You can create a Current account by visiting their website or downloading the mobile app from the Google Play Store or from the App Store. Current has the same requirements as Varo. You will need a personal ID and social security number. After creating your Current account, you will join over four million users who use the Current app for their money management needs.