The Bank Black Movement is not only a show of Black economic power but also a means to close the racial wealth gap between Black America and White America.

What is the Bank Black Movement?

The Bank Black Movement was inspired by the hashtag #BankBlack, which started trending on Twitter following an emotional speech in July 2016 by activist and rapper Michael Render (a.k.a. Killer Mike) on Atlanta’s Hot 107.9 radio following a fatal police shooting of two African American men.

On the radio show, Render encouraged Black people to take their money and deposit it in a black-owned bank as a show of black economic force and to create more economic opportunities in Black communities across the country.

“We don’t have to burn our city down. But what we can do is go to your banks tomorrow. You can go to your bank tomorrow. And you can say, ‘Until you as a corporation start to speak on our behalf, I want all my money. And I’m taking all my money to Citizens Trust.’”

Killer Mike

In the following weeks, Atlanta-based Citizens Trust and numerous other black-owned financial institutions experienced an influx of new depositors who headed the call.

Today, the 21 black-owned banks recognized as Minority Depository Institutions (MDIs) hold over $4.9 billion in assets. They are playing an integral role in the economic empowerment of Black communities across the country.

The Racial Wealth Gap

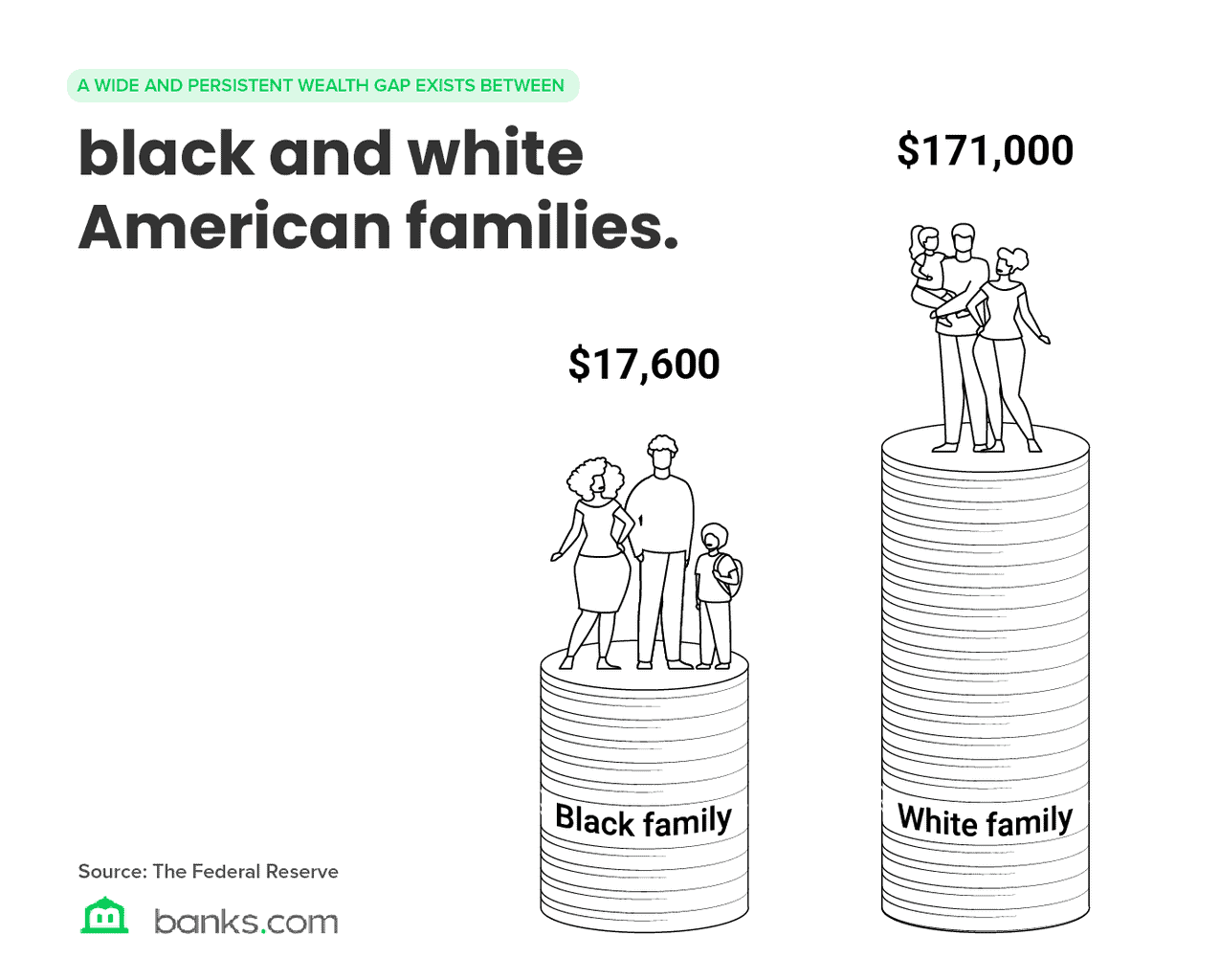

You don’t need a Ph.D. in Economics to know that there is a vast discrepancy between the wealth of Black America and White America. All it takes is a drive through a predominantly Black neighborhood and a mostly white neighborhood. However, the actual data may be worse than you’d expect.

According to a McKinsey & Co report, titled “The Economic Impact of Closing the Racial Wealth Gap,” African American families possess, on average, only one-tenth of the wealth that white families have. While the median household wealth in white families amounted to $171,000, black families’ median wealth came to only $17,600 in 2016.

“The widening racial wealth gap disadvantages black families, individuals, and communities and limits black citizens’ economic power and prospects.”

McKinsey & Co

Moreover, Black families are around 20 times more likely to have zero or negative wealth (meaning their debts outweigh the value of their assets) than they are to have $1 million or more in assets, according to a report by Inequality.org.

What’s more, Black households held around $2.1 trillion in wealth, while white households owned $81.9 trillion in 2018, despite Black people making up over 13% of the US population.

What’s arguably the most alarming, however, is that 37% of Black American households fall under the zero or negative wealth category versus only 15% of white families. That means that over one in three African Americans is only one large unexpected expense away from not being able to pay bills.

While the reduction of the racial wealth gap will require political will and support from legislators, individuals can engage in economic activism by choosing to “bank black.”

Black-Owned Banks’ Role in Reducing the Racial Wealth Gap

Black-owned banks are the cornerstone of the #BankBlack Movement. These community banks provide financial services in underserved neighborhoods to economically empower Black communities.

Banks like OneUnited, Liberty Bank, and Carver Bank provide bank accounts, mortgages, and small business loans, among other services, to ensure that their local communities receive the same financial opportunities as wealthier neighborhoods.

“We are investing in our communities that we serve. 83 cents of every dollar we have on deposit gets reinvested in small business owners and consumers that live in our area.”

Michael Pugh, Carver Bank President and CEO.

By providing financial services to underserved Black communities, as well as low- and moderate-income households, black-owned banks are helping to reduce the racial wealth gap. Lending to consumers and small businesses, which have been neglected or excluded from mainstream financial services, allows them to increase their earning potential. In turn, this leads to more economic growth and empowerment in these communities.

OneUnited Bank President, Teri Williams, is a firm believer in investing and spending in the Black community. She believes that by giving more business to black-owned enterprises, Black people could economically empower themselves without government help.

“There’ve been studies to show that if we could increase the amount of business that we give to black-owned businesses, we could create a million jobs in the black community. That’s something we can do on our own, without government support,”

Ms. Williams told PRI.

A part of making that a possibility is by providing loans and basic financial services to consumers and small businesses in the Black community, which is precisely what black-owned banks are dedicated to.

To #BankBlack means to deposit funds into a black-owned bank to encourage economic empowerment. “[…] What it does is it provides lower-cost funding to black-owned banks and allows us to offer the lending services that we need to offer to these communities,” Williams added.

While closing the racial wealth gap is likely going to take several decades, “buying black” and “banking black” are two essential pieces of the puzzle that Black Americans can engage in today to see a brighter economic future for Black America tomorrow.