Spring EQ provides homeowners with a wide range of options to access their home’s equity and for real estate investors to tap into home equity.

What is Spring EQ?

Homeowners and investors build home equity with property appreciation and monthly mortgage payments. Spring EQ is a mortgage lender that helps homeowners and investors tap into the equity they have built in their properties. Jerry Schiano, the founder and CEO of Spring EQ, started the Spring EQ in 2016 to transform the home equity lending industry. The company has its headquarters in Radnor, PA. Spring EQ provides expert guidance to help you get the best home equity financing based on your needs.

How Does Spring EQ Work?

Spring EQ will look at an application to assess how much to lend a borrower. The second mortgage lender also has an equity estimator calculator that lets you see how much equity you may be able to access. The equity estimator calculator lets you input your estimated credit score, home value, and how much you owe on your home. Based on these estimates, the tool will provide an estimate of the maximum amount of cash you can access from your home.

There are a couple of options for starting the process with Spring EQ. You can contact them on the phone, and their licensed loan advisors will walk you through your home equity options. After selecting the option that’s right for you, the Spring EQ experts will fill out an application with you over the phone.

What Makes Spring EQ Different?

Homeowners can select from many second mortgage lenders. Spring EQ has several advantages that help them stand out from other online lenders.

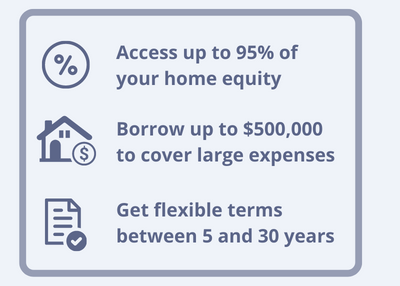

- 95% Home Equity: Most lenders only allow you to borrow up to 80% of your home’s equity. Spring EQ lets you borrow more capital, making it easier to cover large expenses and avoid returning for another loan.

- Quick Delivery: Consumers want more convenience, and some of them need home equity as soon as possible. Spring EQ is faster than a traditional bank or other home equity lenders.

- Borrow up to $500,000: Spring EQ offers loan amounts of up to $500,000 for qualified applicants.

- Flexible terms: Spring EQ offers flexible loan terms ranging from 5 to 30-year terms. Choose the option that best fits your needs.

- Several financial products: Spring EQ offers home equity loans, HELOCs, and other financial products. This variety helps more clients find what they need.

What Types of Mortgage Products Does Spring EQ Offer?

Spring EQ makes it easy to tap into your home equity on your terms. Spring EQ has multiple home equity products, including:

Home Equity Loan

A home equity loan provides an upfront payout based on your home’s equity. You will have a fixed interest rate for your loan and make monthly payments. You do not replace your existing mortgage with a home equity loan. If you like the current mortgage’s interest rate and terms, you can keep it.

HELOC

A HELOC lets you borrow against your home’s equity at any time, but you do not pay interest until you start borrowing against the credit line. This approach gives homeowners more flexibility with how much they borrow and when they take out money. Once the debt is repaid, homeowners still have access to the HELOC and can borrow against it again. HELOCs do not have fixed interest rates. If the Fed raises interest rates, you will have to pay a higher rate.

Is Spring EQ a Reputable Company?

Spring EQ is a BBB-accredited company with an A+ rating. In addition, the second mortgage lender has an average rating of 3.9 out of 5 stars across over 400 Google reviews. Spring EQ is one of the best mortgage companies to get the home equity financing you need.

Access Cash from Your Home with Spring EQ

Spring EQ simplifies home equity financing so you can get the cash you deserve. You’ve spent years building up equity and patiently watching appreciation in home value. You can apply for home equity financing by submitting this simple form or speaking to one of their home equity specialists licensed in your State.