Freedom Debt Relief: Is Debt Settlement for You?

Tired of drowning in debt? Freedom Debt Relief offers debt settlement solutions to help you resolve your outstanding unsecured debts. You can get started with a free consultation, and if you decide to enroll, you can complete the program and get the relief you need in as little as 24 to 48 months*.

Freedom Debt Relief Program

Be Debt-Free In 24-48 Months

Debt Settlement vs. Debt Consolidation

Debt settlement and debt consolidation are both debt relief options, but they vary slightly. When you settle your debts, you agree to pay each creditor an amount lower than what you owe to satisfy the debt. Doing so may negatively impact your credit as the creditor will update the account to “Settled” on your credit report, and the negative mark may remain for up to seven years.

But when you consolidate your debt, you merge multiple debts into a single debt and make one monthly payment. Typical forms of debt consolidation include personal loans and balance transfer credit cards.

How the Freedom Debt Relief Program Works

The Freedom Debt Relief (FDR) Program is divided into four phases: enrollment, building, negotiation, and settlement.

1. Enrollment

Before you can enroll in the debt settlement program, an International Association of Professional Debt Arbitrators (IAPDA)-Certified Debt Consultant will conduct a phone consultation with you to learn more about your financial situation. They will analyze your outstanding debt during the call, determine if you qualify for the program, and communicate options that may work for you.

2. Building

If you are a good fit for the program and decide to move forward, your dedicated consultant will devise a plan of action that fits your budget. The next step is to deposit a monthly payment into your FDIC-insured account instead of paying creditors. These funds will be used when it’s time to settle with creditors and cover settlement fees.

3. Negotiation

After you voluntarily stop paying creditors and start depositing money into a special purpose account, Freedom Debt Relief will contact your creditors and negotiate with them to accept less than the full amount owed so you can save a bundle in interest and keep more of your hard-earned money in your pocket.

There’s no guarantee that a creditor will accept a settlement offer. However, the likelihood of success is far greater than it would be if you continue making monthly payments on your debts. For this reason, clients are encouraged to voluntarily stop remitting payments to creditors and instead ensure they have the funds on hand to cover the agreed-upon settlement amount.

Freedom Debt Relief Program

Be Debt-Free In 24-48 Months

4. Settlement

Each settlement offer accepted by creditors is sent to you for authorization and approval. If you agree to the terms, funds from your FDIC-insured account are used to pay the creditor. You will also pay a negotiation fee to Freedom Debt Relief for services rendered. Once the transaction is processed, you can move on, knowing the debt is behind you.

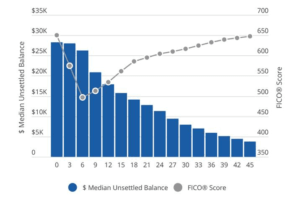

Credit Bureau Reporting

When an account is settled, the creditor reports it as a “settled” account. This notation may be negative, and the account can remain on your credit report for up to seven years. However, one of the most common misconceptions about debt settlement is that it has a long-lasting negative impact on a consumer’s FICO® Score. While the median FICO® Score for FDR Graduates dropped substantially three to six months after a consumer’s enrollment in the program, participants experienced a clear and steady recovery in their FICO® Scores throughout the length of the program.

Types of Debt the Freedom Program Can Help You With

The FDR Program focuses on unsecured debt, including:

- Credit card debt

- Department store debt

- Personal loan debt

- Medical debt

Unfortunately, the program can’t help you with the following types of debt:

- Auto loans

- Mortgages

- Federal student loan debt

- Lawsuits

- Taxes

- Utility bills

Once you’ve completed the program, you can use the funds you formerly used to make unsecured debt payments to focus on secured debts.

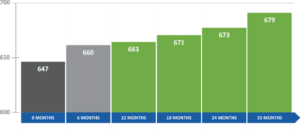

How the Debt Freedom Program Debt Relief Program Affects Your Credit

A study of Freedom Debt Relief Graduates shows that even though the median FICO score declines in the first 6 months of enrollment, it begins a steady recovery process soon thereafter. On average, Freedom Debt Relief Graduates observe higher FICO scores in the two years after graduation when compared to their FICO score at enrollment.

*These findings have been validated by a credit reporting agency and confirm the impact and changes on consumers’ FICO scores during and after the debt settlement program.

The Freedom Debt Relief Program Costs and Fees

You can get started with a free consultation to enroll in the FDR Program. However, a 15% to 25% fee is assessed each time you settle a debt. The negotiation fee depends on your state of residence.

How to Enroll in the Freedom Debt Relief Program

You can learn more about the Freedom Debt Relief Program by submitting an online inquiry or calling 1-800-611-6061. A Certified Debt Consultant will conduct a free phone consultation to review your debts, determine if you’re a good fit for the program, and discuss your options.

Freedom Debt Relief Program

Be Debt-Free In 24-48 Months