What is Unison?

Headquartered in San Francisco and Omaha, Unison offers equity sharing agreements to homeowners who seek unique funding solutions. Their innovative team of real estate and financial professionals can help you leverage home equity to unlock financial success without accumulating extra debt.

How Does Unison Work?

Unison converts a portion of your home equity into cash and disburses it directly to you. This arrangement referred to as an equity sharing agreement, is not a loan. You won’t make any monthly payments or accrue any interest and only pay Unison when you sell your home, reach the 30-year maximum term, default on your agreement, or when the last homeowner on the agreement passes away.

When the agreement ends, you will pay Unison an amount equal to Unison’s payment to you plus Unison’s share of the home’s change in value. An independent third-party appraisal or sales price determines this figure.

Don’t want to sell or buy Unison out? At the 30-year mark, you may have the option to refinance your home and use a portion of the loan proceeds to pay Unison. However, that option may not always be available, and you may need to sell the home.

The Differences Between Unison and Home Equity Loans

When you take out a home equity loan, you receive a lump sum that’s repayable over an extended term in equal monthly installments. But with Unison, you can use the funds without payment until the agreement ends. The agreement ends when you sell your home, when the last homeowner on the agreement passes away, or when you reach the end of the 30-year term. In addition, there is a Special Termination option that allows you to buy out the agreement at any time, but Unison does not share in any loss during a Special Termination.

Is Unison the Same as a Reverse Mortgage?

No, reverse mortgages are a type of debt. Reverse mortgages are available to homeowners with equity who are at least 62 years of age. They permit you to receive your home’s equity as a lump sum, line of credit, or fixed monthly payment. Payments are not required on the loan until you sell your property or pass away, and the interest rates are either variable or fixed.

By contrast, Unison is not debt. It does not have age restrictions, and there are no monthly principal or interest payments. You have up to 30 years to sell your home or buy Unison out without selling, and Unison shares in any increase in your home’s value.

Is Unison a Legitimate Company for Homeowners?

Unison has been in business for over 16 years. They boast an impressive roster of over 10,000 satisfied homeowners and hold an A+ rating with the Better Business Bureau.

The Benefits of Unison

Unison offers a plethora of benefits to homeowners:

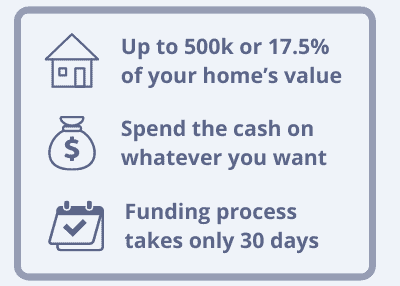

- Tap into a sizable amount of your home’s equity

- No monthly payments

- No debt or interest

- Use the funds however you see fit

What Unison Offers to Homeowners with Home Equity

If you have a sizable amount of equity in your home, Unison can help you access these funds to pay off debt, renovate your home, or use the money to otherwise suit your needs.

Pay Off Debts

Use the equity in your home to unlock financial freedom. Whether you’re burdened by student loans, medical bills, or high-interest credit card debt, an equity sharing agreement would allow you to pay off those debts with cash, rather than adding more debt or payments to the pile.

Renovate Your Home

Instead of taking out a home equity loan or line of credit (HELOC) to fund your home improvements, you can access up to 17.5 percent of your home’s value with Unison. You won’t be stuck making payments for an extended period, so you can focus on completing your renovations and enjoying the new look and feel of your upgraded space, while also directly contributing to an increase in your home’s value.

How to Unlock Your Home Equity with Unison

Unison makes it easy to unlock the equity in your home. Follow these simple steps, and you could be on your way to getting the cash you’ve potentially been paying into for years.

Step 1. Get Pre-Qualified with Unison

To qualify for Unison HomeOwner, Unison generally looks for a middle FICO score of 650 or higher. The required debt-to-income (DTI) and loan-to-value (LTV) ratios will depend on your credit score. Generally, the higher your credit score, the higher the allowable DTI and LTV, but the LTV limit is 70 percent.

If you meet the minimum qualification criteria, complete the brief questionnaire to determine if Unison is a suitable option for you. Unfortunately, Unison is not available in all states. The good news is they’re working hard behind the scenes to expand their offerings, so be sure to check their website for updates.

(Quick note: Unison HomeOwner is available to consumers in Arizona, California, Colorado, Delaware, Florida, Illinois, Indiana, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, Missouri, Nebraska, Nevada, New Jersey, New Mexico, New York, North Carolina, Ohio, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Utah, Virginia, Washington, Washington D.C., and Wisconsin.)

Step 2. Complete a Full Application

If you’re pre-qualified, submit the online application. You can also call the toll-free number to get started.

Step 3. Schedule an Appraisal With the Unison Team

Upon credit approval, a member of the Unison team will contact you to schedule an appraisal of your home.

Step 4. Get Your Funds

The final step in the process is to review your offer letter and closing package. If everything checks out, sign on the dotted line and receive your funds as soon as possible.

Be mindful that delays may occur if additional time is needed to get an appraisal.