iTrustCapital is a Crypto IRA self-trading platform that allows you to invest in Bitcoin, physical gold, and other cryptocurrencies and precious metals in your individual retirement accounts.

What is iTrustCapital?

iTrustCapital is a cryptocurrency retirement account platform with low fees and good customer service. For those looking to invest in digital assets for their retirement, iTrustCapital offers Crypto IRA accounts, commonly known as Bitcoin IRAs. While the company’s marketing is focused on cryptocurrencies, iTrustCapital also provides precious metals as alternative assets for investment opportunities.

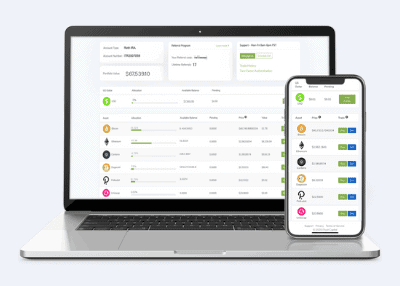

While the company’s main selling point is a long-term investment solution, the trading platform suits other trading styles – like day or swing trading. In addition, through the client dashboard, investors can trade and access their crypto investments almost instantly, 24/7.

Lastly, iTrustCapital provides commercial-grade cold storage for their client cryptocurrency IRAs supported by Coinbase Custody and Fireblocks. These industry-leading institutional storage providers ensure that clients’ cryptocurrencies are safely stored offline and inaccessible to any online attackers.

Altogether, iTrustCapital allows you to put cryptocurrencies into tax-advantaged accounts with a user-friendly interface.

How iTrustCapital Works

iTrustCapital works similarly to most financial institutions. They have an established set of U.S. financial accounts that follow the regulations applicable to the specific IRA rules of the account type you choose.

As a retirement account provider, iTrustCapital offers clients access to self-directed crypto IRAs and their corresponding benefits. The company also provides the necessary customer support for their clients to invest. The main difference is that iTrustCapital focuses on cryptocurrencies and silver and gold to a lesser extent.

Should You Use iTrustCapital?

iTrustCapital offers a particular set of products. If you are looking to diversify your retirement portfolio with any mix of cryptocurrencies and precious metals, they have the solution. Unlike many alternative retirement account providers, iTrustCapital doesn’t charge a monthly account fee. When comparing their fees with these similar platforms, iTrustCapital offers the lowest cost accounts.

iTrustCapital Products

iTrustCapital offers several accounts that cost the same and carry the same minimum requirements. The costs include:

- The setup of your new IRA: Facilitation of transfer/Rollover/Contribution to fund your IRA

- All necessary IRS/Tax reporting

- Unlimited storage with institutional custody partners

- iTrustCapitalplatform support and maintenance

iTrustCapital offers IRAs from which you can purchase cryptocurrency or precious metals all from the same account. You can select which type of IRA you want to open. They offer Traditional, Roth and SEP IRAs you can choose from:

iTrustCapital Traditional IRA

An iTrustCapital Traditional IRA offers the same tax benefits as a regular IRA. They are tax-deferred accounts funded with pre-tax income. You don’t need to pay any taxes on your investment/trading gains until you retire the funds in retirement.

iTrustCapital Roth IRA

Like any other Roth IRA, these accounts are funded with post-tax income. As a result, you pay income taxes for the funds you intend to deposit. But when you start withdrawing the funds in retirement, you will not need to pay any taxes.

iTrustCapital SEP IRA

Simplified Employee Pension IRAs are tax-deferred accounts like Traditional IRAs, but they enable the business owner or sole proprietor to make contributions. For the account owner, the tax benefits are the same as a Traditional IRA.

Cryptocurrencies Available in iTrustCapital

iTrustCapital offers Bitcoin and a large selection of alternative cryptocurrencies assets:

- Bitcoin (BTC)

- Ethereum (ETH)

- Cardano (ADA)

- Chainlink (LINK)

- Polkadot (DOT)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Bitcoin Cash (BCH)

- Stellar (XLM)

- EOS (EOS)

- Uniswap (UNI)

- Compound (COMP)

- Sushi (SUSHI)

- Yearn.finance (YFI)

- Polygon (MATIC)

- Aave (AAVE)

- Solana (SOL)

- Curve DAO (CRV)

- Basic Attention (BAT)

- Enjin (ENJ)

- Algorand (ALGO)

- Cosmos (ATOM)

- Tezos (XTZ)

- Decentraland (MANA)

Precious Metals

iTrustCapital also offers gold and silver. These offerings are physically held at the Royal Canadian Mint and have no storage fees.

iTrustCapital Fees and Account Minimums

All iTrustCapital accounts require an initial investment of at least $1,000, and any additional contribution you choose to make must be no less than $500. iTrustCapital does not charge any monthly maintenance fees. Instead, they charge transaction fees on all cryptocurrency transactions, a 1% trading fee.

There is a flat gold fee of $50 over spot per ounce for precious metals IRAs and a flat silver fee of $2.50 over spot per ounce. These fees are all transparent and straightforward. There are no hidden fees, and in-kind transfers are free.

How to Fund your iTrustCapital Account

You can transfer funds from any existing IRA you have. If you have a job and leave your employer for any reason, you can rollover funds from a:

- 401(k)

- 403(b)

- TSP

- 457

Lastly, you can contribute new funds as long as you follow the annual guidelines.

iTrustCapital Mobile App

iTrustCapital recently launched an intuitive and user-friendly mobile app available for iPhone and iPad devices in the App Store. Through the mobile app, you can set up an account and trade cryptocurrencies the same way as if you were to do it from a desktop. Your account through the mobile app is also secured in the same manner as any other device. Of course, you can still access your accounts and investments through a browser on your P.C. or desktop, but the app gives you extra freedom and more convenience to manage your investments anytime from anywhere.

iTrust Customer Service and Reviews

iTrustCapital isn’t reviewed by institutions like the Better Business Bureau. However, impartial customer review platforms such as Trustpilot reveal that the vast majority of users are satisfied with the service. Only 10% of users on TrustPilot gave the platform less than 4 stars, with 75% giving it a full 5 stars. Professional reviews tend to mirror this result, and iTrustCapital is well-received across the board.

Customers with any questions or concerns are addressed by the company. You can contact them via:

- Email: [email protected]

- Phone: (866) 308-7878

- Online message on the company website

iTrustCapital’s customer support is available Monday to Friday from 8 am to 5 pm US Pacific Time (PST).

How to Get Started on iTrustCapital

Getting started with iTrustCapital is simple. You can set up an account in a matter of minutes. Just go to their website and select “Make a Free Account.” After you verify your email account, you can start accessing the features. To conduct financial transactions, you need to follow their simple steps to verify your identity.

Once your account is active and your identity is verified, you can open a retirement account and fund it. They offer the following accounts:

- IRA

- Roth IRA

- SEP IRA

Once you choose an account, you can choose to fund it through:

- An IRA transfer

- An employer plan rollover

- A USD cash contribution

You can simply DocuSign your formal application and complete all the process online, so you don’t need to worry about mailing documents.