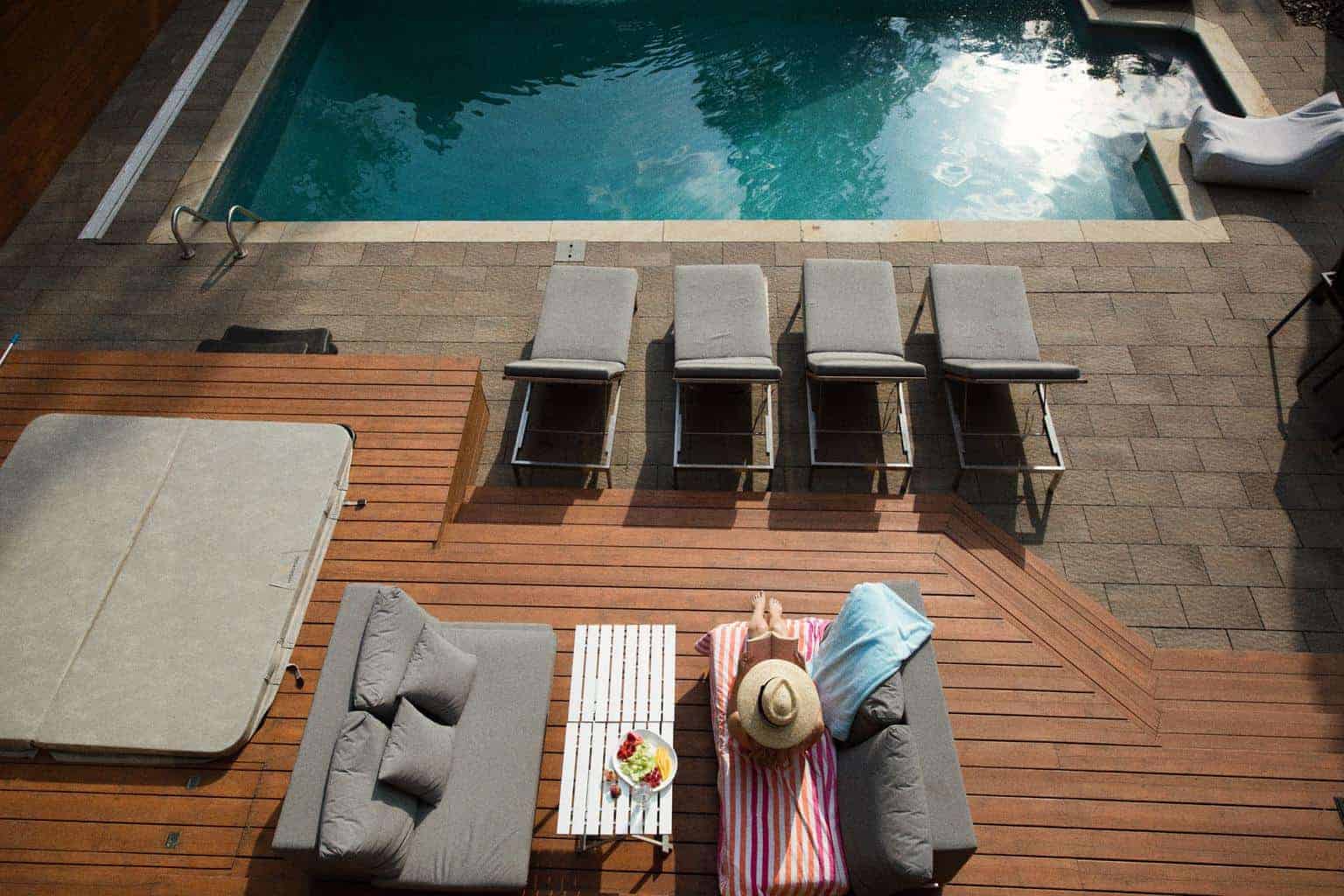

A deck is a perfect place to entertain guests, host family gatherings, have a game night, and more. The list of perks that come with decks is endless, making it a home improvement project worth tackling.

But how much does it cost, and what financing options are best? Read on to learn the answers to these questions and discover another flexible funding source to pay for a new deck.

How Much Does It Cost To Build A Deck?

On average, homeowners spend $14,360 and $19,856 on wooden and composite decks, respectively. Construction costs vary by the size of the area and the quality of the materials used for the project. Other costs to bear in mind may be the cost of building a deck if it is custom work and the deck installation costs.

Here’s a breakdown of what you can expect to pay per square foot (in area), depending on the scope/complexity of the project:

- Over 500 square feet: $15,000 to $45,000

- 200 to 500 square feet: $7,000 to $35,000

- Up to 200 square feet: $4,000 to $14,000

Also, factor in the cost of patio furnishing and future repairs when developing the budget for your renovation project.

Does a Deck Add Value To Your Home?

Most homeowners recoup between 66 and 72 percent of the costs spent on a deck when selling their home. But that’s just one benefit to consider. A new deck also adds intangible value to your home. It provides a space to entertain family and friends and possibly make your home more functional.

Deck Financing Options to Pay for a New Deck

If you’re not planning to pay cash for your deck, there are several ways to finance the project. But with so many options to choose from, finding the best solution can be overwhelming.

Below, you’ll find a breakdown of how each financing option works so you can make the best decision.

Home Equity Loan

With a home equity loan, you can borrow up to 90 percent of your home’s current value (minus your mortgage balance). They also offer a fixed interest rate and predictable monthly payments over the repayment period. The amount you receive will depend on your income, employment history, credit health, and several other factors.

So, if your home is worth $450,000 and you owe $295,000, you could qualify for up to $110,000 ($450,000 * .90 – 295,000). But what if your home hasn’t risen much in value and is only worth $350,000? Using the above example, you’d only qualify for a home equity loan up to $20,000 ($350,000 * .90 – 295,000), which may not be enough to cover the cost of a new deck.

This illustration demonstrates why a home equity loan isn’t always suitable for homeowners seeking to finance a new deck.

Home Equity Line of Credit (HELOC)

A HELOC also lets you tap into your equity to pay for a new deck. Instead of receiving a lump sum of cash, you will have access to the funds and can make withdrawals at any time during the draw period of up to 10 years. You will also make interest-only payments while the HELOC is open.

Once the draw period ends, you will make principal and interest payments over an extended repayment term. The interest rate on HELOCs is variable, and you’ll only repay what you borrow.

Still, they pose the same problem as traditional home equity loans. If you’re a new homeowner or haven’t yet built up a ton of equity, you may not qualify for a HELOC. And if you do, the amount of your line could be far less than what you need to complete your renovation project.

Cash-out Refinance

A cash-out refinance is another common way homeowners fund deck additions. The amount you borrow is added to your existing mortgage and rolled into a new loan with a possibly higher interest rate. You can tap into 80 percent of your home’s equity (minus the outstanding mortgage) if you go this route.

Sounds easy-peasy, but it may not be ideal to get a higher mortgage payment and interest rate for the sake of covering the costs of a new deck.

Personal Loans

If you’ve run across a home improvement loan product to fund your deck project, it’s likely an unsecured personal loan. You’ll need a specific credit score, debt-to-income ratio, and income to qualify. Plus, the interest rate you get could be higher than what’s offered with other forms of financing. Repayment periods are generally brief, so the monthly payment could be problematic for your budget.

Credit Card

Credit cards are a costly way to fund a new deck unless you get a promotional interest card and pay it off before the zero-free interest period ends. Otherwise, you’ll be stuck paying a fortune in interest.