What’s the first thing the vast majority of people do when choosing a bank? The same thing they do when searching for a good doctor, a new restaurant to try, or a nearby dry cleaner – they go online.

While years ago, online reviews of banks were few and far between, this is no longer the case. More people are posting reviews of just about any type of business – and reading them as well.

If your bank is still on the fence about reviews, here is some information about why they are vital for your business and some other tips to make your review management program a resounding success.

Why Online Reviews Matter for Your Bank

Customer reviews have a powerful influence on your bank’s business. They are some of the most accurate indicators of the customer experience and have the potential to either attract or drive away customers. If your bank hasn’t paid much attention to its reviews in the past, here are several excellent reasons why it should start.

1. They Help You Reach More People

Word of mouth is still a “thing,” but many consumers have taken this online. And, even in its traditional form, you’re likely to find that a potential customer will still research a brand after they’ve received a personal recommendation.

Deloitte released a consumer review study concluding that 81% of consumers read reviews and check ratings before making a purchasing decision. In fact, 88% of consumers trust online reviews as much as a personal recommendation.

The reason people trust online reviews is that they are confirmation of a trustworthy and authentic business.

2. They Give You Free Feedback

Banking is a competitive industry. If your bank isn’t running on all cylinders, there’s a good chance you’re going to miss some opportunities.

Online reviews can give you candid feedback about what your bank is doing right and where you might have some room for improvement.

According to The MSR Group, the relationship between a bank and its customer has the biggest impact on customer satisfaction. When you receive online feedback, act on it, and respond appropriately, it will only help your business.

3. Negative Reviews Can Help Your Business

It sounds counterintuitive to embrace negative reviews, but the businesses that do this often reap the rewards.

First, consumers are suspicious when they see a business with only positive reviews. They might think you’re trying to “cook” your virtual books. In fact, research reveals that 95% of consumers won’t book a restaurant with only positive reviews.

Once your pride recovers from getting a poor review, it’s important to publicly acknowledge it, assess the situation, and use it as an opportunity to improve your business, build relationships, or both.

4. They Boost Your SEO

Google wants consumers to have the best search experience possible. So the search engine giant loves reviews. When it comes to ranking your business in local search results, reviews play a factor.

Google will collect and score the quality and number of your reviews to determine your local search position. So, to improve your findability, make sure you are managing and monitoring your online review activity.

5. You Need to Remain Competitive

Reviews are an incredibly important tool for banks to remain competitive, especially smaller/niche/community banks, as consumers are increasingly looking for peer reviews about which products or services to consume.

What your competitors are or aren’t doing matters when it comes to online reviews. If they aren’t focusing on online reviews, you should be so that you can get ahead of the curve before everyone else wakes up. If they are focusing on reviews, you don’t want to be the one left standing when the music stops, and everyone else has been optimizing their approach for months or years.

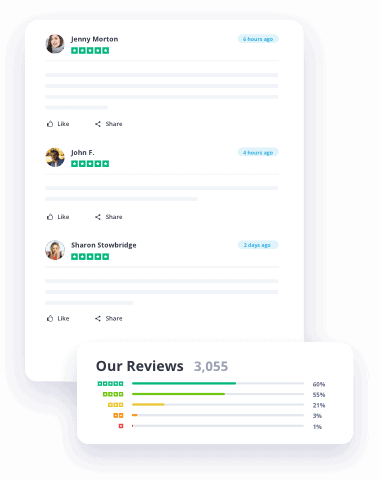

How Many Reviews Does Your Bank Need?

According to a “Local Customer Reviews” study by BrightLocal, customers read an average of 10 reviews online, so having this as your minimum target is best. But, remember, Google is also using your review numbers in its local search algorithm, so it’s vital that you aim to get a steady stream of reviews for your bank.

And they should be recent as well. If consumers click on your Google reviews or the reviews on any other website and find that they are all from more than a year ago, they might think you’ve closed up shop! But, having reviews from last week or last month lets customers know that you are in business and, hopefully, inspiring people to give you a virtual pat on the back.

What’s an Ideal Star Rating for a Bank?

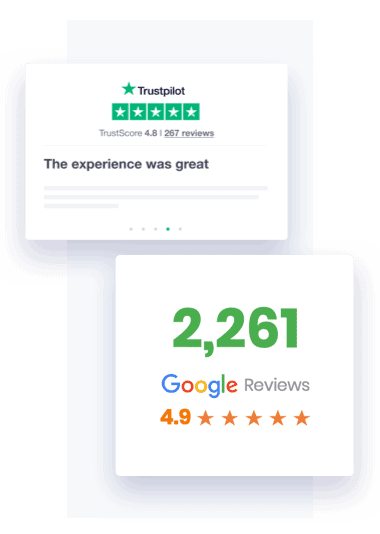

An average rating of at least 4.0 is a good starting point. BrightLocal also reports that 92% of consumers would use a business with an average of 4.0 or higher. And more than half (58%) admit that the star rating is the most important factor in their decision.

If your bank is striving for a 5.0 rating, it may be doing itself a disservice. Remember that distrust that consumers have about the absence of poor reviews? One study by Northwestern University and PowerReviews concluded that an average star rating of 4.2 to 4.5 was the most trustworthy and the range that leads to the highest conversions.

Where Are Customers Posting Online Reviews?

Most customers search for and read customer reviews from a variety of online resources during their research. It’s helpful to have feedback on multiple digital channels so you can meet customers where they’re at. Some of the online sites that you’re likely to find bank reviews include:

General Review and Social Media Sites

- Google My Business

- Yelp

- Yahoo! Local Listings

Niche Review Sites

- Consumer Reports

- Consumer Financial Protection Bureau (CFPB)

- Trustpilot

- Niche financial review websites

Your Website

You can ask for customer reviews on your website, but it’s more common for banks to curate existing reviews for use as testimonials. You can use those review snippets on your home page, sales pages, and a dedicated testimonial page.

How Your Bank Can Get More Reviews

Marketers have been using the phrase, “the customer is always right” for decades. Businesses allocate significant time and resources to create customer-focused experiences from start to finish.

But, how will your bank know if it is missing the mark in one or more areas? Further, there might be some things you are doing so well that you could identify additional opportunities if only you had the right information.

So, what’s the best way to get customers to leave more online reviews for your bank? Here some of the most common strategies that work amazingly well.

1. Verbally Mention That You’d Appreciate Honest Feedback

Train your employees to ask for a review whenever appropriate. Knowing when and how to ask can be an art but also something you can train.

Staff should be able to use their judgment when they have established rapport with a customer, just set up a new account, or resolved an issue, to ask if they’d consider leaving a review.

Asking for a review can apply to both in-branch as well as online and phone interactions.

2. Collect Email Addresses of Customers

Most banks keep in touch with their customers via email these days. If you are already sending your customers newsletters and other vital information about their account, you can take it a step further.

Sure, you could send a blanket email to all of your customers and ask for a review. But you’d likely get a better response if you know that a customer has just been in the branch or called your customer service line.

When you “ask” for reviews, especially in writing, it’s important to understand the rules. For example, Google encourages businesses to ask for reviews, but Yelp discourages the practice.

3. Encourage Reviews with In-store Signage

As a local business with a brick-and-mortar location, you can place a few subtle hints in your branch that will spur more reviews.

Your business can accomplish this with brochures, flyers, window clings, and a simple small sign by the teller.

Taking it a step further, you can have a kiosk in your branch with an app that directs customers to the appropriate review site. Or, you can display a QR code that customers can scan that takes them to your desired reviews site, such as Google My Business.

4. Place Review Reminders on Your Website

You’ll tend to get more reviews if you make it as simple as possible for customers to help you out. In fact, one of the reasons that many people don’t leave reviews is because it seems tedious, and they don’t want to learn how to do it.

So, shortcut the process for them and let them know that it’s “easy and quick.”

Use non-irritating pop-ups and calls-to-action (CTAs) on your website that lead them to your Google My Business or Facebook review page.

5. Leverage Social Media

You can jump on social media platforms like Facebook, Instagram, or Twitter to post specific questions regarding your bank’s performance.

Followers that are interested will be directed to leave a review on their platform of choice. For example, you might informally ask if customers are happy with a new payment app or some other unique feature that you’ve introduced.

This approach not only empowers customers to share their experiences but can also boost your brand’s social media engagement.

6. Respond to Every Single Review

Responding to reviews can seem cumbersome, but this practice is vital to boosting your online reputation. If someone takes the time to leave feedback about your business, you should invest a few minutes to respond.

Further, many consumers scan reviews to see if a brand responds and what they say. When current or potential customers see that you respond to every review, good or bad, they’ll be inspired to leave their own feedback.

When you do respond to online feedback, make your entries unique, appropriate, and timely.

7. Provide an Amazing Customer Experience

When your customers are blown away by the experiences they have with your brand, they’ll be eager to share the good news with others and do something to help you out.

If you’re concerned about getting enough reviews or enough quality reviews, these will begin to roll in when you deliver an exceptional customer experience.

How Banks.com Can Help With Review Generation and Syndication

Most banks rely on word of mouth as part of their marketing strategy. But online reviews have evolved into the modern-day word of mouth. Banks that effectively manage their online reputation will not only rise higher in search results but will also attract more potential customers and get the feedback they need to improve the customer experience.

Banks.com can help your brand increase awareness and engagement with online reviews. Our Review Generation service gives you access to managed campaigns, review collection, templates, automated review collection, and other premium features. Through Review Syndication, you can showcase customer testimonials, syndicate reviews to your profile page, and more.

Contact us to learn more about how Banks.com can help your business expand its brand awareness and improve its bottom-line results.