How to Start Investing

Investing your hard-earned money in the financial markets may seem daunting at first. But it doesn’t have to be, especially once you understand how to get started. In fact, there are only five steps you need to take to start investing:

1. Determine Your Investment Goals

First, you need to decide what your investment goals are. Do you want to purchase a home in five years? Do you want to buy a car in three years? Or are you investing for your retirement?

Your investment goals will determine your investment horizon as well as what mix of investments you want to put into your portfolio.

While choosing your financial goals, you should also think about how much risk you feel comfortable with. As a general rule of thumb, the younger you are, the more risk you can take. As you move closer to retirement, however, you will want to reduce the amount of risk you take.

Your investment goals and your risk preference will determine your investment horizons and the type of investments you will add to your portfolio.

2. Decide How Much You Want to Invest

Determining how much you want to put aside each month for financial investments is a crucial step. The more you can add to your portfolio each month, the faster you will be able to grow your wealth over time.

However, you should only invest as much as you feel comfortable with your financial situation.

3. Choose Your Investments

The next step is to decide what you want to invest in. The world of financial investments is endless. You can invest in stocks, bonds, funds, commodities, cryptocurrencies, and even alternative investments such as art, fine wine, stamps, and antiques.

For most of us, however, investing in stocks, bonds, and ETFs will probably suffice to reach our investment goals.

The key to choosing what you will add to your portfolio is determined by the returns you are looking to generate and how much risk you are willing to take. Stocks are considered risky assets, while government bonds are considered safe assets. Cryptocurrencies, like bitcoin, on the other hand, are classified as high-risk investments.

4. Sign Up for an Investment Account

Once you are clear on what your investment goals are, what you want to invest in, and how much you want to invest, you need to register an account at an online brokerage or an investment platform.

Online brokerages allow you to pick and choose what you want to invest in, while investment apps usually provide automated investment services that help you with your investment decisions.

5. Make Your First Investment

Finally, the last step is clicking the “Buy” button for your chosen investment(s). Whether you are buying your first stock, an ETF, or bitcoin, once you make your first purchase you can officially call yourself an investor.

What Can You Invest in?

Anything that gains value over time is an investment. From Tesla stock and US Treasury bonds to baseball cards and fine wine, anything that increases in monetary value over time can be classified as an investment.

However, the most common investments that you will find in most people’s portfolios are stocks, bonds, mutual funds, ETFs, and gold.

Let’s introduce each of these asset classes.

Stocks

A stock is a share in a publicly traded company. That means when you buy Tesla stock, for example, you own a small part of Tesla. The price of Tesla stock will go up and down in line with the performance of the company.

Bonds

Bonds are IOUs issued by governments or corporations. When you purchase a five-year US Treasury bond, for example, you are giving the US government money that it will repay with interest within five years.

Mutual Funds

Mutual funds are professionally managed investment funds that enable you to gain broad exposure to the financial markets without having to pick your investments yourself. In exchange for a fee, your money is managed by an experienced fund manager.

ETFs

Exchange-traded funds (ETFs) are similar to mutual funds, but the key differences are that they incur lower costs and can be traded like stocks on stock exchanges. Moreover, most ETFs are passively managed funds that track a stock index or a commodity like gold.

Gold

Arguably, the easiest way to get started as an investor is by using one of the many available investment apps. Whether you are looking to trade stocks, invest in ETFs, or buy Bitcoin, there is an app for that.

Best Investment Apps

Arguably, the easiest way to get started as an investor is by using one of the many available investment apps. Whether you are looking to trade stocks, invest in ETFs, or buy Bitcoin, there is an app for that.

If you already have a hold on managing your personal finances but want to start investing in the financial markets, you can start small with micro-investing apps like Acorns or Stash, which enable you to start investing with as little as $1.

Alternatively, you could sign up for digital wealth management services, such as Betterment or Wealthfront, which build low-cost ETF portfolios for you on your behalf. That way, you can have broad exposure to the financial markets without having to actively manage your investments.

If you want to take a more active approach to managing your investments, you could download the popular, zero-fee trading app Robinhood, which enables you to buy and sell stocks, ETFs, and options.

How to Diversify Your Investment Portfolio

“Diversification is the only free lunch” is a popular saying on Wall Street attributed to Nobel Prize laureate Harry Markowitz.

What Markowitz was referring to is that when you diversify your investment portfolio, you can receive the same expected returns but incur a lower level of risk, according to Modern Portfolio Theory.

Example:

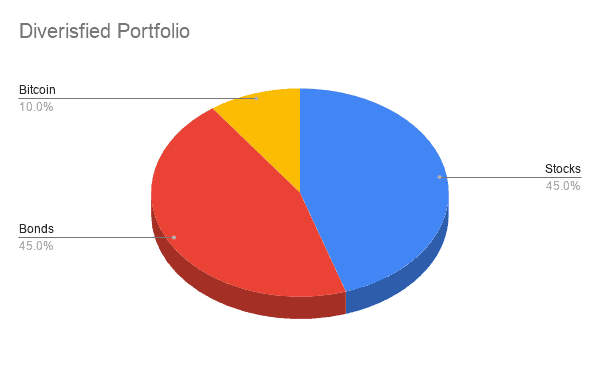

An example of diversification would be a portfolio that is composed of 45% stocks, 45% bonds, and 10% bitcoin. Since the stock and the bond market are historically inversely correlated – which means when one moves up, the other usually goes down – a sudden drop in the stock market would not affect your portfolio as much because half your portfolio is in bonds. Additionally, bitcoin is an uncorrelated asset. It moves largely independently from the stock and bond market, which makes it an excellent diversification asset.

The key takeaway here is that you should not put all your eggs in one basket. If you diversify your investment portfolio correctly, your returns will not suffer, but you will sleep better at night, knowing that the chance of it dropping in value is lower.